|

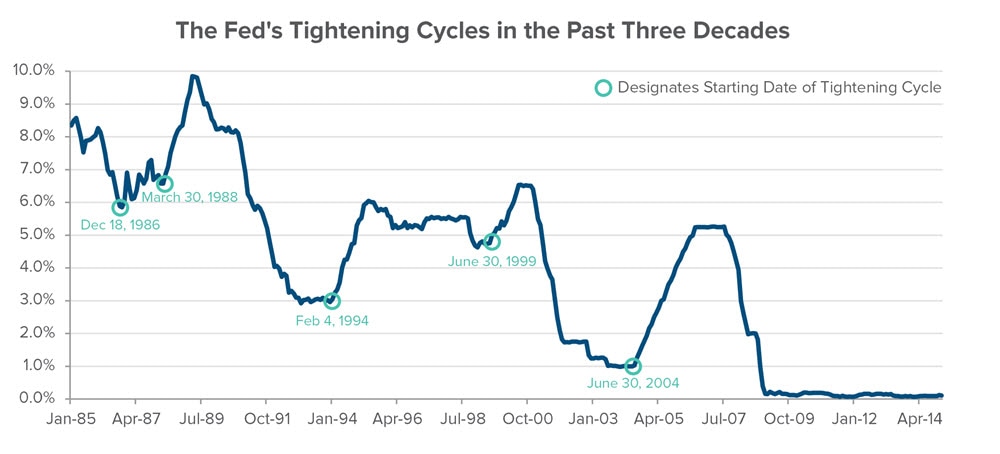

As you’ve likely heard, the Federal Reserve has increased the fed funds rate twice since the Trump Administration took office, for a total increase of .5%. Those increases are on top of the previous .25% increase in December 2015. The Fed has also already indicated it’s likely there will be 3-4 more rate increases this year..... So how do these rate changes affect you? While Fed rate changes do not immediately impact all Adjustable Rate Mortgage (ARM) loans, the near-term direction is clearly increasing. Fed rate changes generally have a fairly quick affect on all indexes to which ARM loans are tied. And once the Fed moves in a certain direction, that trend continues. A quick look at the chart below shows how the Fed generally moves in cycles. Once rate hikes begin, they don’t end quickly...and surely won’t reverse in the near future. Click Here to see a larger version (or click the image below) Recommendation:

For those with ARM loans adjusting any time in the next 3-4 years, it might make very good sense to refinance into a fixed rate mortgage to take advantage of fixed rates that are still near all-time lows. You’ll notice in the chart above, once a “tightening cycle” (rate increase) begins, it takes on average about 5 years for rates to return to pre-tightening levels. For those with ARM loans that still have 4+ years on the fixed rate portion of the loan, you may be able to ride out the savings with your current ARM loan and catch the next downturn. Feel free to contact us with questions regarding your specific loan...we’re happy to take a look and help in any way we can! Comments are closed.

|

|

© 2024 Peshke Financial Inc., all rights reserved. NMLS #2244878. DRE #02210589. "Making Finances Simple. Changing Lives." is a registered trademark with USPTO. Material contained in this website is for informational purposes only and is not meant to be construed as direct financial advice for your specific situation. It is recommended that you consult with your own advisors for any personalized financial guidance. Since we’re not licensed attorneys, we cannot provide legal advice. As such, any info contained in this website should not be construed as direct legal advice. Individual Licensure (see profiles) - click here. Send Docs Securely - click here. Privacy Policy - click here.